investment fund

Our Core Investment Structure

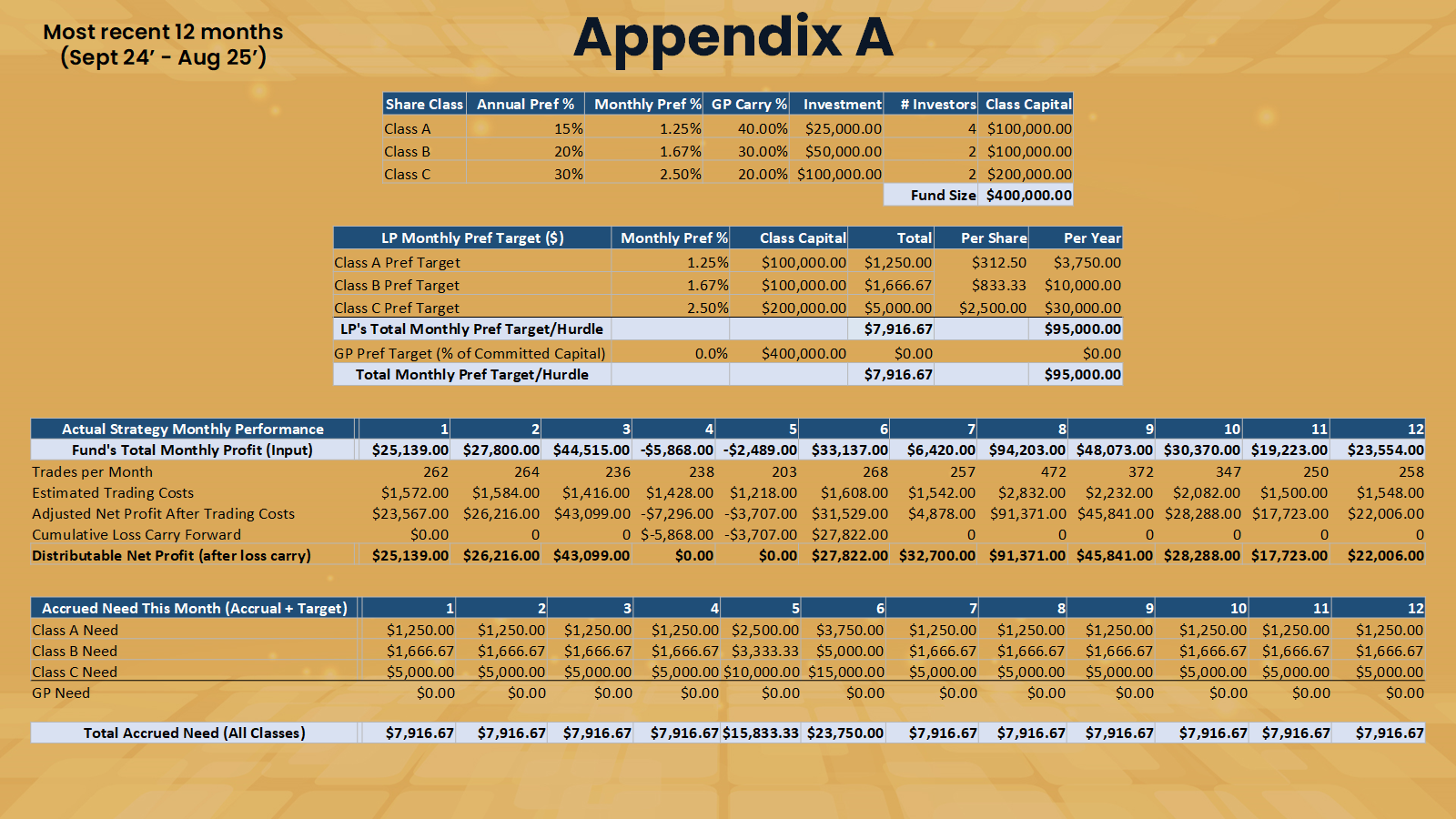

Initial Fund size

Target: $400K

Fund Structure

Waterfall with accruing payouts, Limited Partners paid first

Fund Term

Open-ended

Minimum Investment

$25K class A, $50K class B, $100k class C

Annual Preferred Rates

15% class A, 20% class B, 30% class C (unpaid months accrue)

Strategy

Multi-strategy diversified automated trading

Focus

Gold Futures (initial focus)

First Close

Target: November 2025

Live Fundraising Progress

Performance based

Profit Sharing

Achieve the financial freedom the markets were meant to offer—through a fully automated trading system with real, proven results.

At NQHero, we believe in performance-first compensation. That means no management fees—we only earn when you do. If the portfolio experiences a drawdown, no performance fees are collected until all losses are fully recovered. We win together, and we recover together.

To further demonstrate our commitment, we also offer a preferred return on investment (depending on your share class) before any profit sharing begins. This level of alignment and accountability makes us stand out as the smart choice for your investment—and it reflects the confidence we have in our system.

Don’t pay for promises—pay for results. That’s the NQHero difference.

Our Investment Framework

New investment

Allowed

Distribution policy

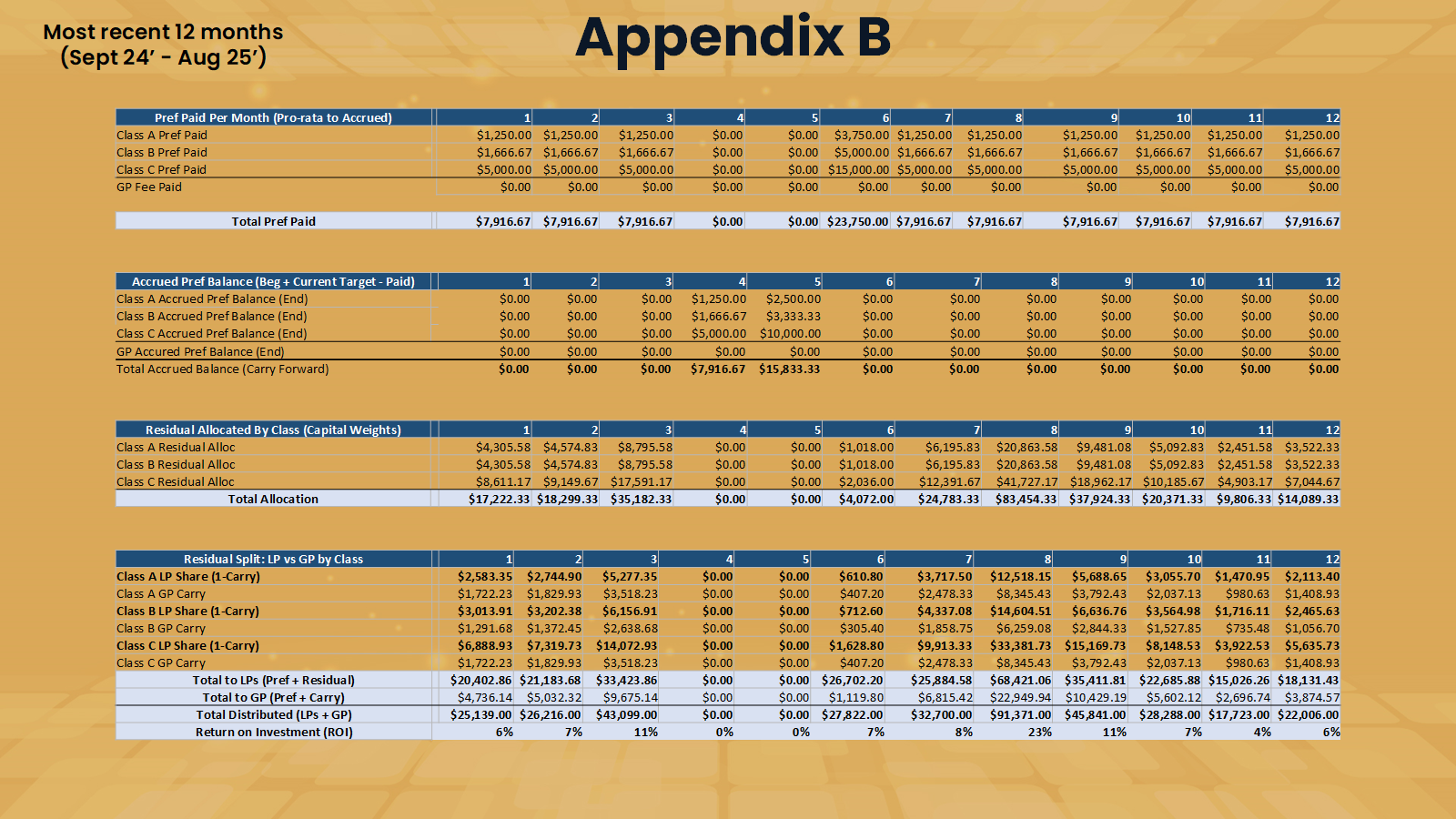

Waterfall structure, LPs receive preferred rate (hurdle) first

Distribution frequency

Monthly (undistributed preferred rate amounts accrue)

Lock-up period

1 year

Redemption policy

Semi-annual withdrawals with 30-day notice

Redemption fee

0%

Waterfall Structure

Profits

Accrue monthly and are first allocated to Limited Partners (LPs)

Losses

Carried forward and must be fully recovered before new payouts

Payouts

LPs receive their preferred return before anything else

Accruals

Any unpaid preferred returns carry forward until satisfied

Remaining Profits

After loss recovery + pref payouts, residual is split by share class

Performance Fees

GP only earns carried interest after LP hurdles are met

Management Fees

0% (vs. typical 2% in the industry)

Our Strategy Targets

50% Annualized Return

Share class

Investment

Management

fee (1)

Annual

preferred rate (2)

Performance fee (3)

Net targeted

return

Class A

$25K

0%

15%

40%

41%

Class B

$50K

0%

20%

30%

47%

Class C

$100K

0%

30%

20%

53%

2. The minimum return to Limited Partners (LPs) before the General Partner (GP) earns any performance fees.

3. The share of profits GP receives after LPs have received their preferred rate.

Profit Distribution

Flow-through example based upon actual historical outcomes to illustrate the process

real Trading. Real results.

Invest Securely

Transparent Structure. Professional Oversight. Investor Aligned.

At NQHero, all trading is conducted live using our proprietary, fully automated algorithmic systems. These strategies are executed within the fund under strict risk controls and are continuously monitored. Investors benefit from the performance of a diversified, multi-strategy and multi-asset portfolio—without the need for direct account management or day-to-day involvement.

We provide:

Timely and accurate NAV reporting

Full transparency into fund performance and activity

Audit trails and compliance oversight

This structure is designed to protect investors, eliminate conflicts of interest, and ensure operational integrity, so you can invest with confidence—knowing that security is always aligned with your interests, and that your capital is managed professionally with transparency and trust.

preferred share options

Choose your desired share class

25k

ClASS 'A' SHARES

- 15% Preferred Rate.

- 60/40 Profit Split.

- Monthly Payout net trading costs.

- profits not taken until deficits are recovered.

- 40% Annual Net Targeted Return.

50k

CLASS 'B' SHARES

- 20% Preferred Rate.

- 70/30Profit Split.

- Monthly Payout net trading costs.

- profits not taken until deficits are recovered.

- 50% Annual Net Targeted Return.

100k

CLASS 'C' SHARES

- 30% Preferred Rate.

- 80/20 Profit Split.

- Monthly Payout net trading costs.

- profits not taken until deficits are recovered.

- 60% Annual Net Targeted Return.